XRP Price Prediction: Navigating Whale Exodus and Bullish Technical Patterns

#XRP

- Technical indicators show mixed signals with price below moving average but MACD maintaining bullish divergence

- Whale selling pressure creates near-term headwinds despite positive institutional rumors and partnerships

- Critical support at $2.8164 with resistance at $3.33 - break either direction could determine medium-term trend

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Support

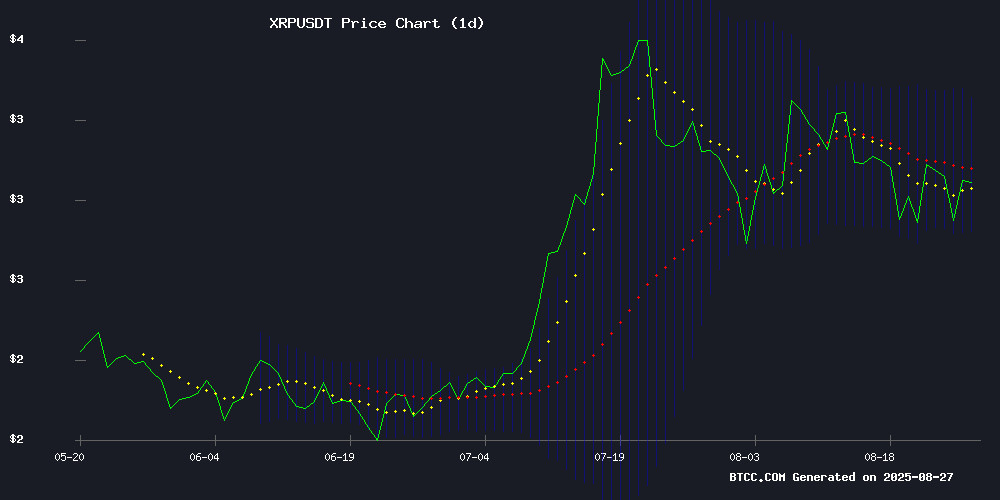

XRP is currently trading at $3.0055, slightly below its 20-day moving average of $3.0736, indicating potential short-term weakness. The MACD reading of 0.1434 above the signal line at 0.0811 suggests lingering bullish momentum, though the histogram at 0.0623 shows weakening upward pressure. According to BTCC financial analyst Mia, 'XRP is testing crucial support NEAR the lower Bollinger Band at $2.8164. A break below this level could trigger further selling toward $2.70, while holding above $3.07 could signal renewed strength toward the upper band at $3.3307.'

Market Sentiment: Whale Exodus Contrasts With Bullish Predictions

Market sentiment for XRP appears divided as whale selling pressure contrasts with optimistic analyst projections. Negative headlines about whale exits and resistance levels are tempered by bullish predictions reaching up to $37-$10,000 valuations. BTCC financial analyst Mia notes, 'While technical uncertainty and whale distribution create near-term headwinds, partnerships like Gemini-Mastercard's launch and Flare's non-custodial earn account provide fundamental support. The rumored institutional interest from BlackRock and JPMorgan could eventually override current selling pressure.'

Factors Influencing XRP's Price

Big XRP Price Warning: Ripple Whales Are Quietly Exiting the Market

XRP whales are reducing their holdings amid the cryptocurrency's rally, signaling potential volatility ahead. On-chain data reveals a steady outflow from large wallets since late 2024, with accelerated selling in 2025. Despite rising prices, these major holders appear to be offloading positions to retail traders.

Retail sentiment remains bullish, with Leveraged long positions climbing alongside funding rates. The divergence between institutional exit and retail enthusiasm creates a precarious balance for XRP's price stability. Market observers note this classic distribution pattern often precedes significant corrections.

CryptoQuant analyst Maartunn's data shows no sustained whale accumulation during the rally. Brief pauses in selling during mid-year failed to reverse the overarching trend of large accounts moving assets out of long-term storage. The current $3 support level faces mounting pressure from these underlying dynamics.

XRP Price Recovers Slightly, Faces Key Resistance Levels

XRP shows tentative recovery signs after dipping to $2.824, now testing the $3.00 psychological level. The 100-hour SMA and a newly formed trendline at $2.970 provide near-term support, but bulls face stiff resistance at $3.050 - a breakout level that could propel prices toward $3.120.

Technical indicators reveal a precarious balance. The 50% Fibonacci retracement level has been breached, but the 76.4% level at $3.050 poses the next challenge. Market sentiment mirrors broader crypto trends, with Bitcoin and ethereum exhibiting similar correction patterns.

Kraken's XRP/USD charts highlight the make-or-break scenario: sustained momentum above $3.10 could signal trend reversal, while failure may trigger retests of recent lows. The coming sessions will prove decisive for directional confirmation.

XRP Consolidates at $2.93 Amid Gemini-Mastercard Launch and Technical Uncertainty

XRP is currently consolidating at $2.93, showing modest gains despite the activation of a significant market catalyst. The Gemini-Mastercard credit card partnership has propelled the exchange past Coinbase in the U.S. iOS App Store rankings, drawing substantial institutional interest.

Technical indicators paint a mixed picture. XRP's price reflects a moderate intraday range, with controlled volatility characteristic of consolidation phases. The RSI remains neutral, nearing oversold territory, while moving averages show conflicting signals—trading below some key EMAs but holding support above others. The MACD hints at weak bearish momentum, though stabilization appears possible.

Market observers note the divergence between fundamental developments and technical performance. The Gemini partnership represents a major adoption milestone, yet XRP's price action remains restrained within its consolidation pattern.

Analyst Foresees XRP's Potential Beyond Payments, Predicts $10,000 Valuation

Crypto analyst Pumpius argues that XRP's utility extends far beyond mere payment processing, positioning it as a cornerstone of future digital identity systems. The XRP Ledger's infrastructure could anchor biometric and genetic data as Immutable identifiers in the coming financial paradigm.

Governments and institutions increasingly view digital ID as inevitable for transactional systems, with biological markers emerging as the ultimate trust layer. The DNA protocol's live implementation on the XRP Ledger demonstrates this isn't theoretical—it's operational infrastructure capable of handling trillion-dollar flows.

Crypto Analyst Predicts XRP Bull Run Could Propel Price to $37

XRP's price volatility has intensified, with the token oscillating between $2.78 and $3.12 this week. Despite a 400% year-over-year gain, analyst CryptoBull argues the true bull run hasn't begun, drawing parallels to the 2015-2018 cycle that preceded XRP's historic rally.

Technical analysis suggests a potential surge to $37, eclipsing the current all-time high of $3.65. The $3 level now serves as both support and resistance, with market watchers scrutinizing whether this consolidation mirrors the prolonged accumulation phase seen in previous cycles.

Rumored Ripple NDA Links Trump, BlackRock, and JPMorgan to XRP Ledger Projects

A leaked non-disclosure agreement has sparked speculation about Ripple's involvement with high-profile entities including former President Donald Trump, BlackRock, and JPMorgan. The document suggests collaboration on projects integrating digital identity, healthcare, and global settlement systems using the XRP Ledger.

The revelation centers on biometric identity mapping technology, which would connect personal identification with financial infrastructure. This development contradicts previous statements by Ripple CEO Brad Garlinghouse, who had expressed caution about government-controlled digital identity systems.

Healthcare applications are already emerging, with Wellgistics Health implementing an XRP Ledger-based payment network for 6,500 U.S. pharmacies. JPMorgan's public focus on digital identity as a foundational technology lends credibility to these rumors.

MoreMarkets Partners with Flare to Launch Non-Custodial XRP Earn Account

MoreMarkets has teamed up with Flare Network to introduce the XRP Earn Account, a non-custodial solution enabling XRP holders to generate on-chain yield without navigating multiple blockchains or complex DeFi mechanics. The integration leverages Flare's FAssets system to mint FXRP—a 1:1 representation of XRP—while the original assets remain securely on the XRP Ledger.

Users bridge XRP from their XRPL wallets via MoreMarkets' interface, automatically deploying yield strategies like lending or liquid staking through Flare's Firelight protocol. Rewards are converted back to XRP and returned to users, streamlining participation for non-technical investors. "This collaboration unlocks programmable utility for XRP," MoreMarkets stated, highlighting accessibility as a Core advantage over custodial alternatives.

The solution distinguishes itself through its fully on-chain architecture, eliminating centralized custodians by relying on Flare's oracle-secured collateral system. MoreMarkets abstracts the technical complexity behind a single dashboard, positioning the product as a gateway for mainstream XRP holders to access DeFi yields.

XRP Price Poised for Breakout as Technical Patterns Align

XRP's price action is drawing intense scrutiny from analysts as multiple technical indicators converge on a bullish outlook. Dark Defender, a prominent crypto analyst, asserts that disparate analytical frameworks—from Cup and Handle formations to Elliott Wave theory—all point toward an imminent surge. The cryptocurrency has completed the rounded base of its Cup and Handle pattern on weekly charts, with the handle's corrective phase now nearing completion.

Fibonacci levels add further conviction, with XRP holding firmly above the 23.06% retracement at $2.85. This consolidation sets the stage for what Dark Defender describes as a "powerful breakout," potentially propelling the asset toward a $5.85 target corresponding with the 261.8% Fibonacci extension. Market participants are watching for confirmation of this impulsive wave, which could validate months of accumulation.

Is XRP a good investment?

XRP presents a high-risk, high-reward investment opportunity at current levels. The cryptocurrency shows technical resilience trading above $3.00 despite whale selling pressure, while fundamental developments including institutional partnerships and potential adoption beyond payments provide long-term optimism.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $3.0055 | Neutral |

| 20-Day MA | $3.0736 | Slight Resistance |

| MACD | 0.1434 | Bullish |

| Bollinger Position | Middle Band | Neutral |

| Support Level | $2.8164 | Critical |

BTCC financial analyst Mia suggests: 'Investors should consider dollar-cost averaging given the mixed signals, with strict risk management below $2.80. The $2.93-$3.33 consolidation range will likely determine the next major move.'